The Truth about Estonian Startups and Taxes

|

| Not sure if Estonian startup cheerleaders can handle the truth. |

Last week, the Estonian tax authority (EMTA) published a list of how much each Estonian company paid in payroll (employment) taxes for August and September of this year. Shortly after that, Ragnar Sass (who readers may remember from our profile of his failed United Dogs and Cats startup that cost the taxpayer over half a million euros) published his own list showing how much Estonian startups paid from that sum. In his own words: “pure data, not some hype or bullshit bingo”

Well we over at the Dot EE Bubble also like data, so when we woke from our Viru Valge-fueled drunken stupor on Monday morning (blame Sunday’s Estonia-England match), we knew it was time to act.

|

| Next time he should try Sovietsko and Vana Tallinn |

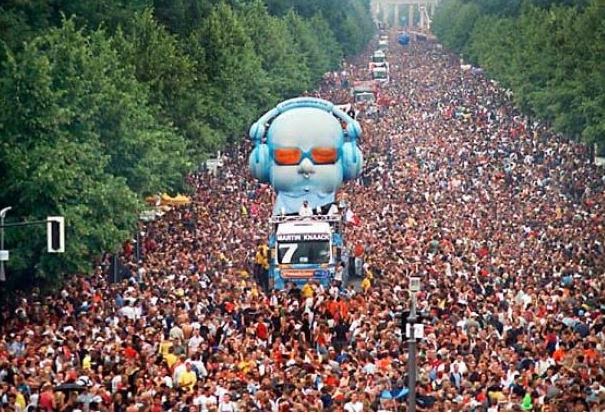

We found it interesting that people are bragging that Estonian startup companies do what every company should be doing – paying their taxes. What’s next, a presidential parade when they submit their annual financial reports? (More on that later.)

|

| Crowds celebrating a startup that filed their VAT declaration on time |

Sadly, maybe there is reason to celebrate when an Estonian startup pays their taxes as required by law. We’ve profiled companies on this blog, like Complus Consulting that ran off with nearly 1.4 million euros of taxes owed, and Yoga Intelligence that pulled a similar trick by bankrupting the company with tax debts and starting a new one.

Anyway, back to the data. The companies on the list are probably familiar to anyone following the Estonian startup scene. These essentially represent all startup companies currently operational (with paid employees) in Estonia. In other words, this list gives us a fairly comprehensive overview of the Estonian startup environment. We sent our experienced research team to dig further into these startups, and analyze the results.

|

| You'd also have the same look after sifting through numerous EAS funding databases. |

First, the good news. A lot of Estonian startups are doing well in our book. They follow the path of startups in other countries, by using private funding to build their company and be successful, all while complying with the relevant laws and paying taxes. One example is Creative Mobile, a company we profiled last year. (Yes, we can be positive sometimes!)

Now the bad news, a bit more than half (23/45) of startups have received taxpayer money, and a lot of it:

|

| Remember these names. They're living off your money! |

Yes, you read that correct. More than HALF of the top Estonian startups have received taxpayer money.

How much? 13,318,415 euros. Yes more than 13 MILLION euros of taxpayer money.

Among startups that took taxpayer money, the average funding amount was 579,061 euros

The last column in the chart shows how many times each startup took taxpayer money. What do we learn from that? Taxpayer money is nearly as addictive as cocaine – of the startups that took government funding they received it an average of 3.7 times.

|

| An easy choice for Estonian startups -- more taxpayer money please! |

Depressed already? It gets worse. As of October 13, 7 of the companies on the overall list have a tax debt, in total worth 70,831 euros.

|

| "Paying taxes is for chumps!" |

And remember those annual reports we mentioned earlier? Five startups have not filed their 2013 annual report as they are legally required to, including Now! Innovations, Click & Grow [corrected October 15], Cherry Media, and Majandustarkvara (Erply). Two of the five,

Some will say that these government handouts are good. The taxes paid by startups shows they are “giving it back”. But are they? For some startups that either pay a lot in taxes or took little government money, they pay back in taxes what they received in a month or two. Meanwhile, some, like Visitret Displays, would need to pay taxes at the current rate for 519 months – 43 YEARS – to pay the taxpayer back. Now Visitret is certainly the extreme, but the average across companies is 49.1 months – more than 4 years.

|

| Number of months to pay back taxpayer funding -- see you in 4 years! |

Lessons Learned

Is this really how things are supposed to work? Half of the top Estonian startups have received an average of more than half a million euros each of taxpayer money.For a better way to handle things, simply look at just about every other country out there. We don't think there's one country where half of all the country's startups are funded by the government. In many free markets, like the US and UK, investing is left to private investors who are highly experienced and motivated to invest well. We've heard the argument that there is no private investor money in Estonia, but we simply don't buy that argument. Just one quick look at EstBAN's presentation shows there is plenty of investor money available, and many private investors willing to help.

Why does Estonia need to have the government dump millions into startup companies, when every other country has successfully left this to the private market?

Footnote on Numbers

Some of the numbers include not only money from Enterprise Estonia (EAS) which typically is a handout, but also money from SmartCap which is usually in the form of an equity investment or convertible loan (and effectively a handout unless the company does well). SmartCap is the taxpayer-funded investment arm of the Estonian Development Fund (Arengufond). Despite being publicly-funded, they don’t make the numbers easily available on how much they invested in each company, so we had to go to some of our sources. If you have an issue with any of the numbers for a company, just complain in the comments (like we need to ask you!) and we’ll provide information on how we arrived at that number.