E-Residency to Be Granted to All Refugees

FOR IMMEDIATE RELEASETallinn, Estonia, 1 April 2016. The Estonian government announced today a revolutionary solution to the European migrant crisis. Starting today, all refugees and asylum-seekers will be granted Estonian e-residency.

"As the largest per-capita recipient of EU funding in all of the EU, we knew it was time to do our part and help solve the European migrant crisis." said Taavi Babyface, Estonia's prime minister. "Estonia, land of Skype and Transferwise, is an innovative country and we came up with an innovative solution, unlike those pesky Germans. Rather than having all these migrants travel to Europe, we'll just grant them e-residency and they can stay at home!"

The solution helped to appease some of the biggest critics of accepting refugees, like member of parliament Karl Closedmind. He commented: "The EU wanted us to take in 550 refugees to Estonia, and that's simply too much for a tiny country like Estonia. All these Middle Eastern, Muslim, Arabic-speaking immigrants will destroy Estonian culture and language. There will be kabob shops on every corner, and we'll have to make Ramadan a national holiday. Some people say that with such a small number of refugees, this won't happen, but I tell you they're wrong! Did you know there are over 600 American immigrants living in Estonia? Now look what happened! There's a McDonalds on every corner, we have a national holiday for Christmas, and all the Estonian kids are speaking English and using iPhones! Damn those Americans, why did we ever let them in!?"

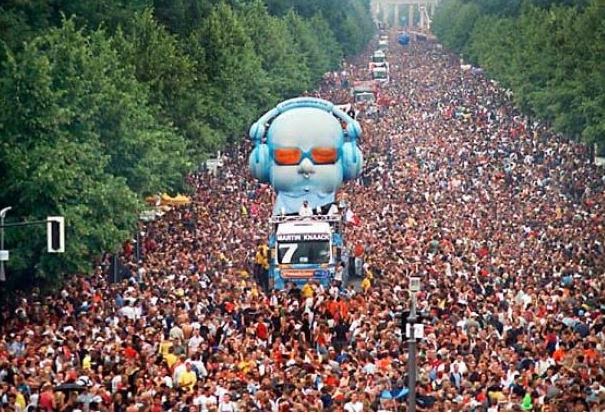

|

| Refugee problem solved! [Photo Credit] |

In terms of how the e-residency program would work for refugees, Kaspar Optimist, program manager for e-residency, said: "It's simple: The applicant just needs to go to the nearest Estonian embassy to apply and show their documents, and we have one in Ankara, Turkey. The fee is only 100 euros, and Ankara is a short flight from most countries in the Middle East. In preparation for millions of applicants, we've increased embassy staffing there from 3 people to 4 people. That's a 33% increase!"

When asked what refugees can do with their e-residency card, Prime Minister Babyface beamed: "Many of these refugees are coming to Europe to work, so with e-residency, they won't need to. They can use their e-residency card to start a business online, set up a bank account, and even digitally sign documents! It's a great way for them to earn money while staying in their home country."

Some refugees spoke highly of the announcement. Mohammed Ali, a resident of Homs in Syria, said: "This is great! I can start a business using my e-residency card and earn money to support my family! My first idea was to create a website that is a social network for dogs, but I see that was already done by an Estonian company. They say the best ideas for a business come from right around you, so I decided I'm going to start a company that builds houses from empty bullet casings and used tank treads. That's pretty much all my village exists of now anyway!"

Another potential e-resident, Suleiman Al-stonia from the village of Azaz near Syria's Kurdish border, was equally excited: "This e-residency sounds great! I can start a company and sign documents online! I plan to apply as soon as electricity returns to my village and I can buy a computer. Well, I may have to wait a while as the entire village has been bombed to rubble, but I'm sure the computer store will open once the village is rebuilt. In the meantime, do you have any food? I haven't eaten in 3 days and our village is surrounded by militias."

|

| Plans to start company online... as soon as the bombing is over. |

In fact, some refugees have already obtained their e-residency cards. One young Syrian reported: "So I got my e-residency card and had big plans to head to Estonia, but the guards at the border fence in Hungary wouldn't let us through! What good is this thing?"

|

| Hungarian border guards not fond of e-residency |

Another refugee with e-residency knew better though: "I'm staying in my village here in Syria and I plan to start a business and sell cookbooks. My cookbooks will be unique as all the recipes are about making a meal for only one person. I had a family of 7, but they were all killed in the bombings except for me. The same goes for many people in my village, so this cookbook will definitely sell well. Thanks Estonia for offering me this great e-residency!"

Despite all the positive news about e-residency, the ultra-right anti-immigrant group Soldiers of Odin was not pleased. Martin Jarhead, lead soldier of the Estonian branch, said: "This is an abomination to give e-residency to all these dark-skinned, swarthy refugees! Soon, our e-stonia will be overrun with Muslim men of Middle Eastern origin. Our fair-skinned Estonian women will be afraid to surf the internet at night. It's already happening, too. I heard a rumor that one Estonian girl was e-raped by an e-refugee. He tried to insert his e-residency card into her e-card reader, and he didn't even ask her PIN code! These men are animals!"

Responding to criticism from ultra-right racist groups, Prime Minister Babyface said: "Look, we set a goal of gaining 10 million e-residents by 2025, and we're only at 10,000 so far. With our declining population, the only way to reach that goal is with immigrants. Oh, and April Fool's!"